Home

Construction Insurance

Other Insurance Products

Get A Quote

Insurance FAQ

Glossary

Insurance Links

Newsletter

Contact Us

Our Other Sites

|

FAQ: Frequently Asked Questions:

Professional Liability (Malpractice) FAQ

Business Insurance FAQ

Workers Comp Insurance FAQ

Employment Practices Liability FAQ

Directors & Officers Liability FAQ

Surety Bond FAQ

Health & Life Insurance FAQ

Personal Insurance FAQ

Professional Liability (Malpractice) Frequently Asked Questions:

What is professional liability (Malpractice) insurance?

Professional Liability (sometimes called Errors & Ommissions), also called malpractice insurance, protects the professional (Doctors, attorneys, architects and many other professionals) from errors, ommissions or adverse events arising from that professional's practice. Majority of professional liability policies are written on a "Claims Made" basis, whereas majority of "General Liability" policies are written on "Occurrence" basis. Some carriers may also offer professional liability on an Occurrence form.

>> Back to FAQ

What is a claims-made policy?

A claims-made policy covers claims against the insured only if the claim is made and reported while coverage is still in effect. Therefore a tail must be purchased to extend this reporting period beyond the time the policy cancels or expires.

>> Back to FAQ

What is an occurrence policy?

An occurrence policy covers claims against the insured if the incident that gave rise to the claim occured when the policy was in force, regardless of when the claim is reported (even years later). Therefore in an occurrence form policy the purchase of a tail is not necessary when the policy cancels or expires.

>> Back to FAQ

What is 'prior acts coverage'?

Prior acts coverage, also known as 'nose coverage' can be purchased as an alternative to tail coverage. This is done when insured purchases coverage from a new carrier when changing insurance companies. It provides coveragre back to the retroactive date for incidents that may have occurred in the past but have not yet been reported.

>> Back to FAQ

What is a retroactive date?

Retroactive date is the date on which coverage first began. A claims made policy provides coverage for an incident which happened on or after retroactive date and for which the claim is reported while the policy is in force.

>> Back to FAQ

What is "Locum Tenens" ?

Locum Tenens simply means a substitute physician. This coverage protects you and the substituting physician for any malpractice incident arising out of the substitute physician's practice while treating your patients. Normally this coverage is not automatic and needs to be added by endorsement onto your policy, in which case an application for the Locum Tenens needs to be first submitted to the insurance carrier and must get the underwriter's approval befroe the substitute physician can practice on your behalf in your absence. A per diem charge is applied to your policy for this endorsement.

>> Back to FAQ

What is "Of Counsel" ?

American Bar Association Formal Opinion 90-357 provides four acceptable definitions of the term:

- A part-time practitioner who practices law in association with a firm, but on a basis different from that of the mainstream lawyers in the firm. Such part-time practitioners are sometimes lawyers who have decided to change from a full-time practice, either with that firm or with another, to a part-time one, or sometimes lawyers who have changed careers entirely, as for example former judges or government officials.

- A retired partner of the firm who, although not actively practicing law, nonetheless remains associated with the firm and available for occasional consultation.

- A lawyer who is, in effect, a probationary partner-to-be: usually a lawyer brought into the firm laterally with the expectation of becoming partner after a relatively short period of time.

- A permanent status in between those of partner and associate, having the quality of tenure, or something close to it, and lacking that of an expectation of likely promotion to full partner status.

What is the best way to change insurance carriers?

When changing insurers, you must be sure to prevent any gaps in coverage. This can be accomplished by either purchasing a 'tail' (run-off) coverage from the previous isurer, or by purchasing a 'nose' (prior acts) coverage from the new carrier. You must make sure the retroactive date on the new policy is the original effective date of the previous policy in order to have prior acts coverage back to the same original date.

>> Back to FAQ

What happens when I retire or leave my practice?

If you are planning to retire or leave your practice, be sure to purchase a tail coverage. Depending on the insurer, there are usually several tail options available with different durations and each has its own cost associated with it. be sure to consult with your broker for your specific situation.

>> Back to FAQ

Get a Professional Liability/Malpractice Insurance Quote

Business Insurance Frequently Asked Questions:

Does business insurance coverage vary for different businesses?

It can. Many small businesses opt for package policies that cover the major Property and Liability exposures as well as for a loss of income. A common package policy used by a small businesses (or a small office) is called the Business Owners Policy (BOP).

Generally, BOPs provide more complete coverage at a lower price than separate policies for each type of insurance needed (such as Fire, Liability, Loss of Incoome, etc.). However as your business grows, BOPsmay not be available for larger businesses or thosewith higher risks associated with their operations. We can help you decide which policy or policies are right for your business. You can also purchase additional coverage for perils or conditions otherwise excluded (e.g., flood & earthquake protection) as endorsements to a standard policy or as a separate, second policy called a Difference in Conditions (DIC) policy.

>> Back to FAQ

Get a Business Insurance Quote

Workers Comp Frequently Asked Questions:

How does the California Workers Compensation system work?

Workers' compensation is the oldest social insurance program; it was adopted in most states, including California, during the second decade of the 20th century. It is a no-fault system, meaning that injured employees need not prove the injury was someone else's fault in order to receive workers' compensation benefits for an on-the-job injury.

The workers' compensation system is premised on a trade-off between employees and employers -- employees are supposed to promptly receive the limited statutory workers' compensation benefits for on-the-job injuries, and in return, the limited workers' compensation benefits are the exclusive remedy for injured employees against their employer, even when the employer negligently caused the injury.

This no-fault structure was designed to -- and in fact did -- eliminate the then prevalent litigation over whether employers were negligent in causing workers' injuries. Litigation is now over other issues, such as whether the injury was sustained on-the-job or how much in benefits an injured worker is entitled to receive.

>> Back to FAQ

Do I need to have workers' compensation insurance?

California law requires employers to have workers' compensation insurance. Even out-of-state employers may need workers' compensation coverage if an employee is regularly employed in California or a contract of employment is entered into here.

>> Back to FAQ

My spouse and I are the sole owners of our business. We have no employees. Are we required to obtain workers' compensation coverage?

Generally, if you are the sole owners of the business, coverage for yourselves, is optional if you wish to pursue it. You would need to have workers' compensation coverage for any employees you may hire. You should consult with your attorney, insurance agent or broker, or carrier regarding the specifics of you situation and your options.

>> Back to FAQ

Are executive officers or directors of the company covered in its workers' compensation policy?

Generally, all employees of the company, as legally defined, including corporate officers and directors, must be included in the policy unless they are the sole owners of the firm, in which case they may elect not to be covered. Several sections of the California Labor Code must be considered here. You should consult with your attorney, insurance agent or broker, or your carrier regarding the specifics of your situation.

>> Back to FAQ

Where do I get workers' compensation insurance?

You can get workers' compensation insurance coverage from any of the more than 300 private licensed insurers authorized to sell such policies in California. Most policies are sold through an insurance agent or broker.

The largest workers' compensation carrier is State Compensation Insurance Fund (State Fund). If you can't find an insurer willing to cover your business, State Fund is required to provide you with coverage.

>> Back to FAQ

How much does workers' compensation insurance cost?

Workers' compensation insurance premium rates were deregulated several years ago. They may now vary from carrier to carrier. Like any good consumer, you should shop around for a carrier that best meets your needs. Cost is one consideration, but there are other factors you should look at: the services they provide, how convenient will it be to work with them how familiar they are with your industry, etc. If you have a broker or agent, check with that person.

>> Back to FAQ

This is a family business and I'd like to pay my employee's treating doctor cash. Is that OK?

No, it is illegal for an employer to pay medical bills directly. You must file a claim form (DWC form 1) with your claims administrator for all injuries that require more than first aid.

>> Back to FAQ

What determines our premium?

A number of factors go to into determining the annual premium that your insurance carrier will charge. These include: your industry classification; your company's past history of work related injuries (known as your experience modification), your payroll; any special underwriting adjustments, such as use of a certified Health Care Organization; and any special group or dividend programs that you may be eligible for. For further information and advice on how to lower your rates, please contact our office.

>> Back to FAQ

Can I be fined for not carrying workers' compensation insurance?

Yes. If the Division of Labor Standards Enforcement (State Labor Commissioner) determines that an employer has failed to secure workers' compensation coverage, a stop order will be issued and served (Labor Code Section 371.1). This order prohibits the use of employee labor until the coverage is obtained, and failure to observe it is a misdemeanor punishable by imprisonment in the county jail for up to 60 days or by a fine of up to $10,000, or both. (Labor Code Section 3710.2). The Division of Labor Standards Enforcement will also assess a penalty of $1,000 per employee employed at the time the stop order is issued and served. (Labor Code Section 3722(a)).

In addition, if an injured worker files a workers' compensation claim that goes before the WCAB, (Workers Compensation Appeals Bureau) and the workers' compensation judge finds that the employer had not secured insurance as required by law, then, when the adjudication becomes final, the uninsured employer may be assessed a penalty of $10,000 per employee employed at the time of injury if the worker's case was found to be compensable, or $2,000 per employee employed at the time of injury if the worker's case was noncompensable, up to a maximum of $100,000 (Labor Code Section 3722(b).

Finally, as noted in a previous question, failure to secure workers' compensation insurance when you knew, or reasonably should have known, that it is required, is a misdemeanor "punishable by imprisonment in the county jail for up to one year, or by a fine of up to ten thousand dollars ($10,000) or by both that imprisonment and fine." (Labor Code Section 3700.5)

>> Back to FAQ

Can my employees contribute for workers' compensation insurance?

No. Workers' compensation insurance is part of the cost of doing business. An employer cannot ask employees to help pay for the insurance premium.

>> Back to FAQ

Get a Workers Comp Insurance Quote

Employment Practices Liability Insurance (EPLI) Frequently Asked Questions:

Why do I need EPLI for my business?

The number of lawsuits filed by employees against their employers has been rising. While most suits are filed against large corporations, no company is immune to such lawsuits. Recognizing that smaller companies now need this kind of protection, some insurers provide this coverage as an endorsement to their Business Owners Policy (BOP). An endorsement changes the terms and conditions of the policy. Other companies offer EPLI as a stand-alone coverage.

EPLI provides protection against many kinds of employee lawsuits, including claims of:

- Sexual harassment

- Discrimination

- Wrongful termination

- Breach of employment contract

- Negligent evaluation

- Failure to employ or promote

- Wrongful discipline

- Deprivation of career opportunity

- Wrongful infliction of emotional distress

- Mismanagement of employee benefit plans

Get an Employment Practices Liability Quote

>> Back to FAQ

Directors & Officers Liability Insurance (D&O) Frequently Asked Questions:

How does Directors & Officers Liability policy differ from our company’s General Liability policy?

Directors & Officers Liability insurance is liability insurance payable to the directors and officers of a company, or to the organization(s) itself, to cover damages or defense costs in the event they suffer such losses as a result of a lawsuit for alleged wrongful acts while acting in their capacity as directors and officers for the organization. Such coverage can extend to defense costs arising out of criminal and regulatory investigations/trials as well; in fact, often civil and criminal actions are brought against directors/officers simultaneously. It has become closely associated with broader management liability insurance, which covers liabilities of the corporation as well as the personal liabilities for the directors and officers of the corporation.

Get a Directors & Officers Liability insurance Quote

>> Back to FAQ

Surety Bond Frequently Asked Questions:

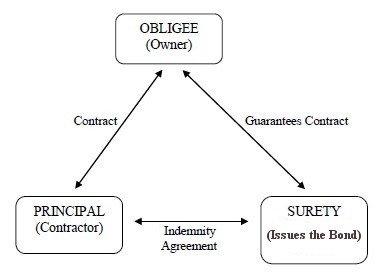

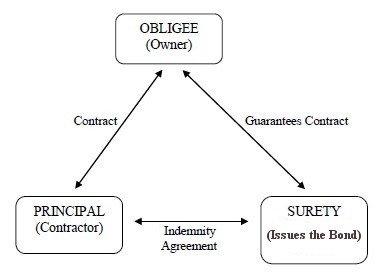

What is a surety bond, when is it needed and how does it work?

A surety bond is a contract among at least three parties:

- The obligee - the party who is the recipient of an obligation,

- The principal - the primary party who will be performing the contractual obligation,

- The surety - who assures the obligee that the principal can perform the task

The surety (bonding company) pays out cash to the limit of guarantee in the event of default of Principal to uphold his obligations to Obligee, without reference by Obligee to Principal and against obligee's sole verified statement of claim to the surety. Through a surety bond, the surety agrees to uphold — for the benefit of the obligee — the contractual promises (obligations) made by the principal if the principal fails to uphold its promises to the obligee. The contract is formed so as to induce the obligee to contract with the principal, i.e., to demonstrate the credibility of the principal and guarantee performance and completion per the terms of the agreement.

Get a License Bond (Call)

Get a Bid/Performance Bond (Call)

Get an Improvement Bond (Call)

>> Back to FAQ

Health & Life Insurance Frequently Asked Questions:

What is Health Insurance & What are the Types?

Click Here for Answer

What is Life Insurance & What are the Types?

Click Here for Answer

Get a Same Day Individual Health or Life Insurance quote

Get a Same Day Group Health Insurance quote

>> Back to FAQ

Personal Insurance Frequently Asked Questions:

Auto:

How does where I live affect my premium?

Where you keep your car directly affects your chances of having an accident or becoming a victim of theft or vandalism. The likelihood of encountering these problems increases in larger, more densely populated cities, while such incidents remain relatively low in rural areas.

Additionally, the time and efficiency of police response and law enforcement, local road and traffic conditions, and the quality of local medical services can affect regional insurance rates. Some insurers even factor in the litigation rates in a given area (how many lawsuits are filed, go to trial, out of court settlements, and their amounts).

>> Back to FAQ

Do all states require some kind of Liability insurance?

No. Although not every state requires Auto insurance, some have "financial responsibility" laws mandating all drivers to be able to pay for any damage or injury they might cause. However, Liability insurance is still the best way for you to meet your state's financial responsibility requirements.

By law, all states offer UM and UIM (Uninsured Motorist & "Under Insured" Motorist) policies, including no-fault states. In fact, some states require all motorists to carry this coverage in order to gain protection from inadequate insurance coverage of other drivers.

>> Back to FAQ

How do I keep my insurance company from canceling my policy?

Besides maintaining a clean driving record, consider investing in special safety and security features for your car. If you've been in an accident, consider taking a defensive driving course.

>> Back to FAQ

What happens when I loan my car to someone? Is that person covered by my policy? Am I still covered?

Yes. Liability and coverage for Physical Damage (i.e. Comprehensive and Collision) always follow your car. Plus, if the driver of your car is insured, his/her policy will also be available to cover the cost of damages and injuries.

The same rules apply when you borrow someone else's vehicle; your own insurance follows you no matter whose car you're driving. But the vehicle owner's policy is the key coverage in the event of an accident.

>> Back to FAQ

Am I covered for natural disasters or "Acts of God"?

Comprehensive insurance, which covers you for fire and theft, generally covers you against damage by flood, earthquake, hail, and other natural perils, except when your car is overturned (which is technically considered a collision). If you have specific concerns about the safety of your vehicle in natural disasters, contact us for information on catastrophic coverage.

>> Back to FAQ

How can I challenge my insurers if they refuse to cover a claim?

Usually, insurers that refuse to cover a claim have a strong legal reason for doing so - even if you disagree. First, contact us if you feel you're being treated unfairly. Your agent/broker is your strongest advocate in insurance matters. But if it's a legal problem, you might have to hire a lawyer.

>> Back to FAQ

Get an Auto Insurance Quote

Homeowners:

Who decides on the type of insurance, the mortgage company or me?

You do. The mortgage company collects a set amount from you each month in order to protect their investment. This money is put in escrow and covers your insurance and taxes. However, the policy is still yours and you might select the insurance you feel offers the best coverage at the best rates.

>> Back to FAQ

What exactly does a Homeowners policy cover?

"Exact" coverage is impossible to define because there are different policies and about 900 insurance companies writing Property/Casualty business in the United States. However, 80% of Homeowners policies are based on a standard form. All Homeowners policies cover two important areas: Property and Liability.

Property insurance covers your structures and possessions. Personal Liability, as its name implies, means you're legally obligated to pay money to another person for actions caused by you, your family, or your property. That liability extends to medical payments to others for injuries caused by you or your family.

>> Back to FAQ

Are floods, earthquakes, and other natural disasters covered?

Most catastrophes are covered. Flood and earthquake damage, however, are not covered by a standard policy and both perils are more common than many people realize. We can advise you on such normally excluded conditions as floods and earthquakes.

>> Back to FAQ

Are there exclusions I should know about?

Exclusions listed and defined in your policy might include neglect, intentional loss, "earth movement," general power failure, and even damage caused by war. If you fail to take care of your property (e.g., a leaky roof), you might not be covered. Obviously, if you intend to lose an object or damage your property, there's no coverage.

One other exclusion that can be costly is the Ordinance or Law exclusion. Building codes established by governmental bodies that drive up the cost of rebuilding or repairing after a loss occurs might not be covered by your insurance policy. Thus, if you discover when replacing damaged property that current law demands higher grade or more expensive materials than those you're replacing, the new materials might not be covered fully.

>> Back to FAQ

Get a Homeowners Insurance Quote

|